Your Path to Homeownership Starts Here

Repairing Your Credit for Mortgage Approval

Buying a home is one of the most exciting milestones in life, but if your credit score isn’t where it needs to be, securing a mortgage can feel like an uphill battle. The good news? A credit rejection isn’t the end—it’s just the beginning of your journey to financial success.

This guide will help you understand how credit affects mortgage approval, interest rates, and the total cost of homeownership. By following these steps, you’ll gain the tools to rebuild your credit, unlock better loan terms, and move confidently toward owning your dream home.

Chapter 1

Why Your Credit Score Matters for a Mortgage Loan

Many first-time homebuyers underestimate how much their credit score influences their mortgage options. Lenders use your credit score to determine how much of a risk you pose as a borrower. A higher score means better loan terms, while a lower score can lead to higher costs—or even denial.

Here’s why improving your credit score is so important:

Higher Loan Approval Chance

Lenders favor borrowers with good credit, giving you more options for home financing.

Lower Monthly Payments

A reduced interest rate means smaller monthly mortgage payments, making homeownership more affordable.

Lower Interest Rates

Lower Total Interest Paid

Over a 30-year loan, even a small rate difference can save you thousands.

Chapter 2

How Credit Affects Your Mortgage Costs

A higher credit score doesn’t just get you approved—it saves you money. Let’s look at how credit affects your mortgage interest rate and total costs over time.

Example: 30-Year Fixed Mortgage on a $300,000 Home Loan

| Credit Score | Interest Rate | Monthly Payment | Total Interest Paid |

|---|---|---|---|

| 750+ | 7.0% | $1,996 | $418,400 |

| 700-749 | 7.5% | $2,098 | $455,280 |

| 650-699 | 8.0% | $2,201 | $492,360 |

| 600-649 | 8.5% | $2,315 | $531,400 |

A difference of just one percentage point can cost you tens of thousands in extra interest over the life of your loan. That’s why improving your credit before applying is one of the smartest financial moves you can make.

The Long-Term Impact: Your Credit & Loan Amortization

Your credit score doesn’t just affect your mortgage rate—it determines how much of your payments go toward interest versus building equity over time.

Let’s break it down with a 30-year fixed mortgage on a $300,000 home:

-

With a 750+ credit score at 7.0%, your monthly payment is around $1,996, and you’ll pay $418,400 in total interest over 30 years.

-

With a 620 credit score at 8.5%, your monthly payment jumps to $2,315, and your total with interest paid skyrockets to $531,400 over the life of the loan.

That’s a $319/month difference and $113,000 more in interest—just because of a lower credit score!

But the impact goes deeper. Mortgage loans are front-loaded with interest, meaning in the early years, a higher percentage of your payment goes toward interest instead of building home equity. With a lower credit score, you’ll take much longer to reach a point where your payments make a real dent in your loan balance.

A strong credit score doesn’t just save you money—it helps you build home equity faster, making it easier to refinance, sell, or leverage your home’s value when needed

Chapter 3

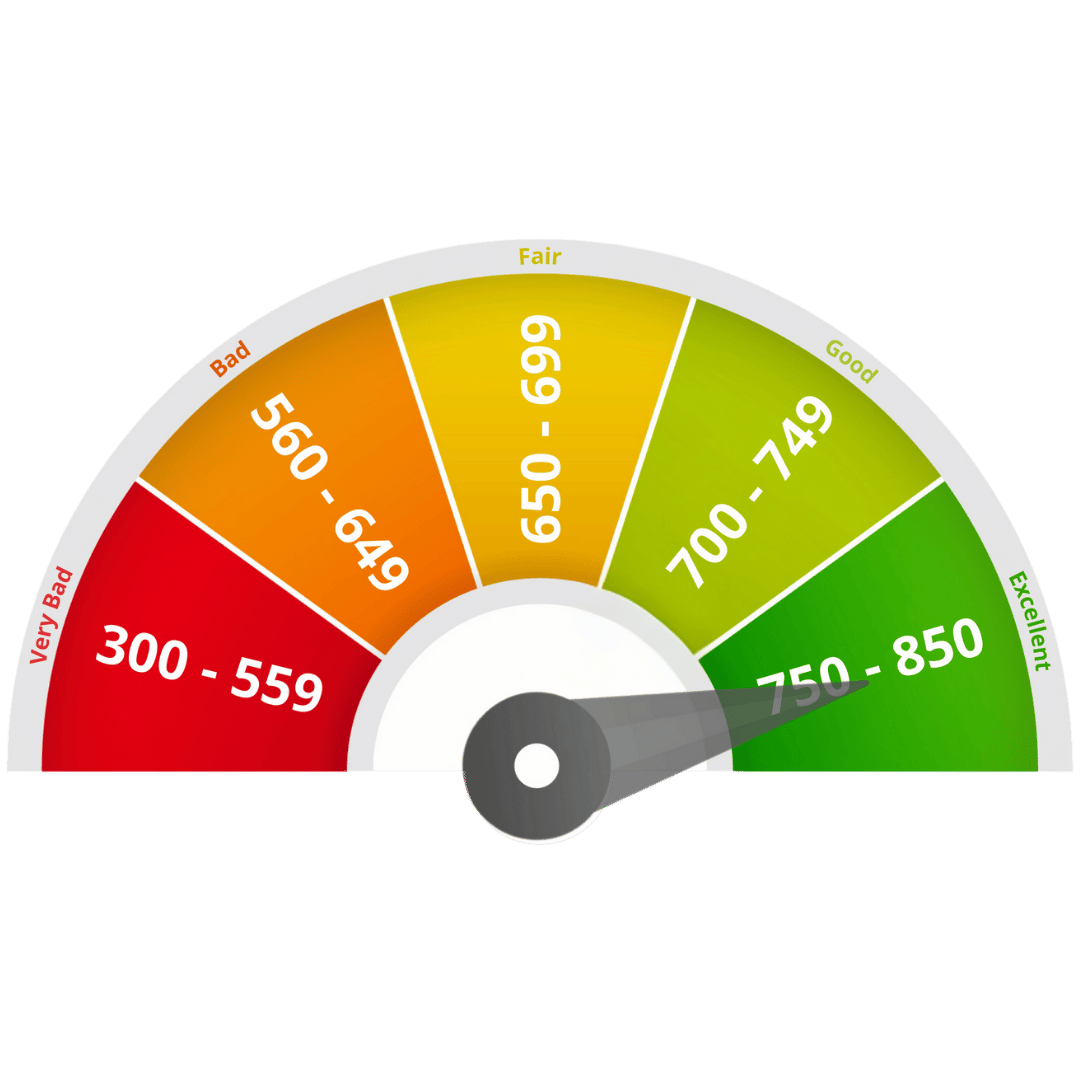

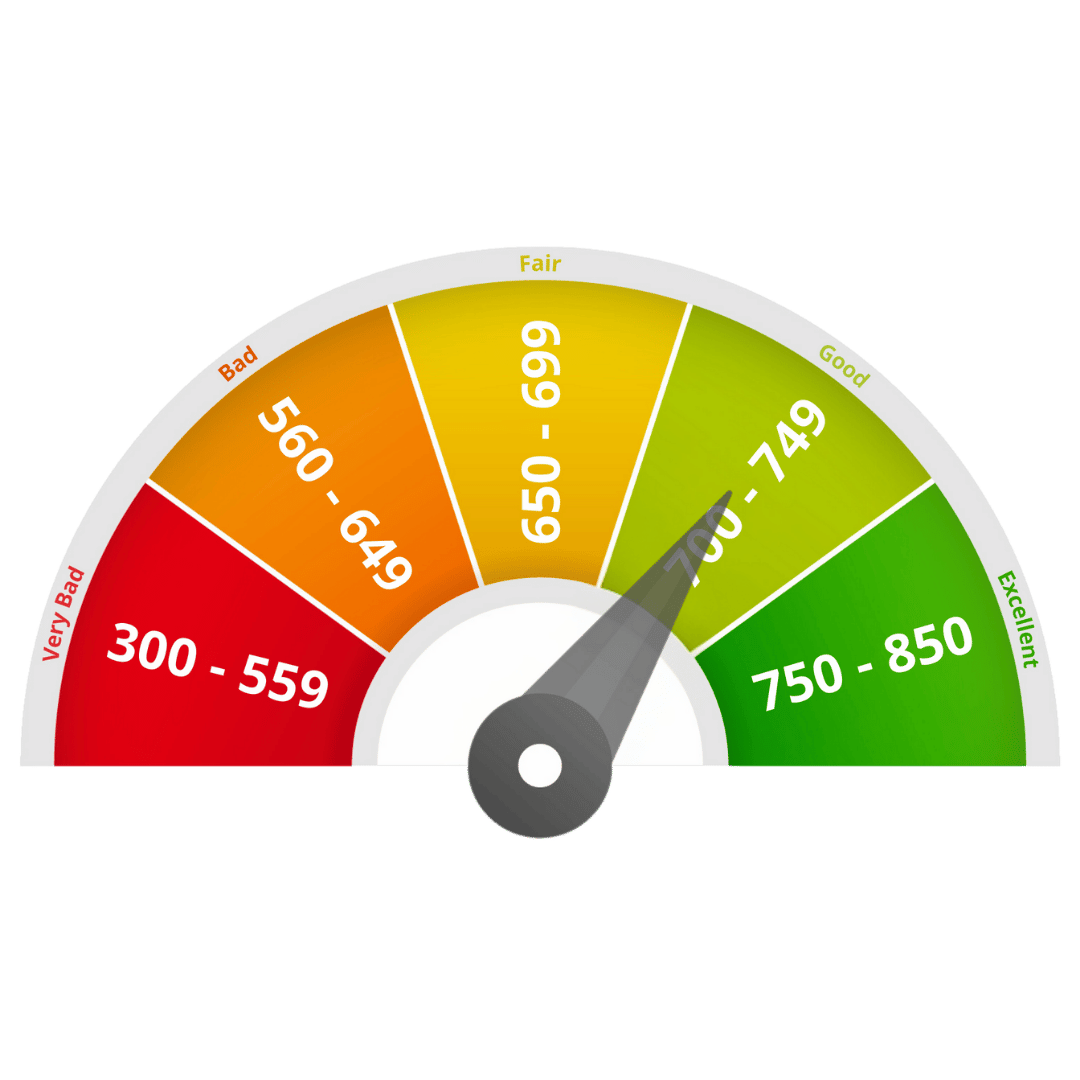

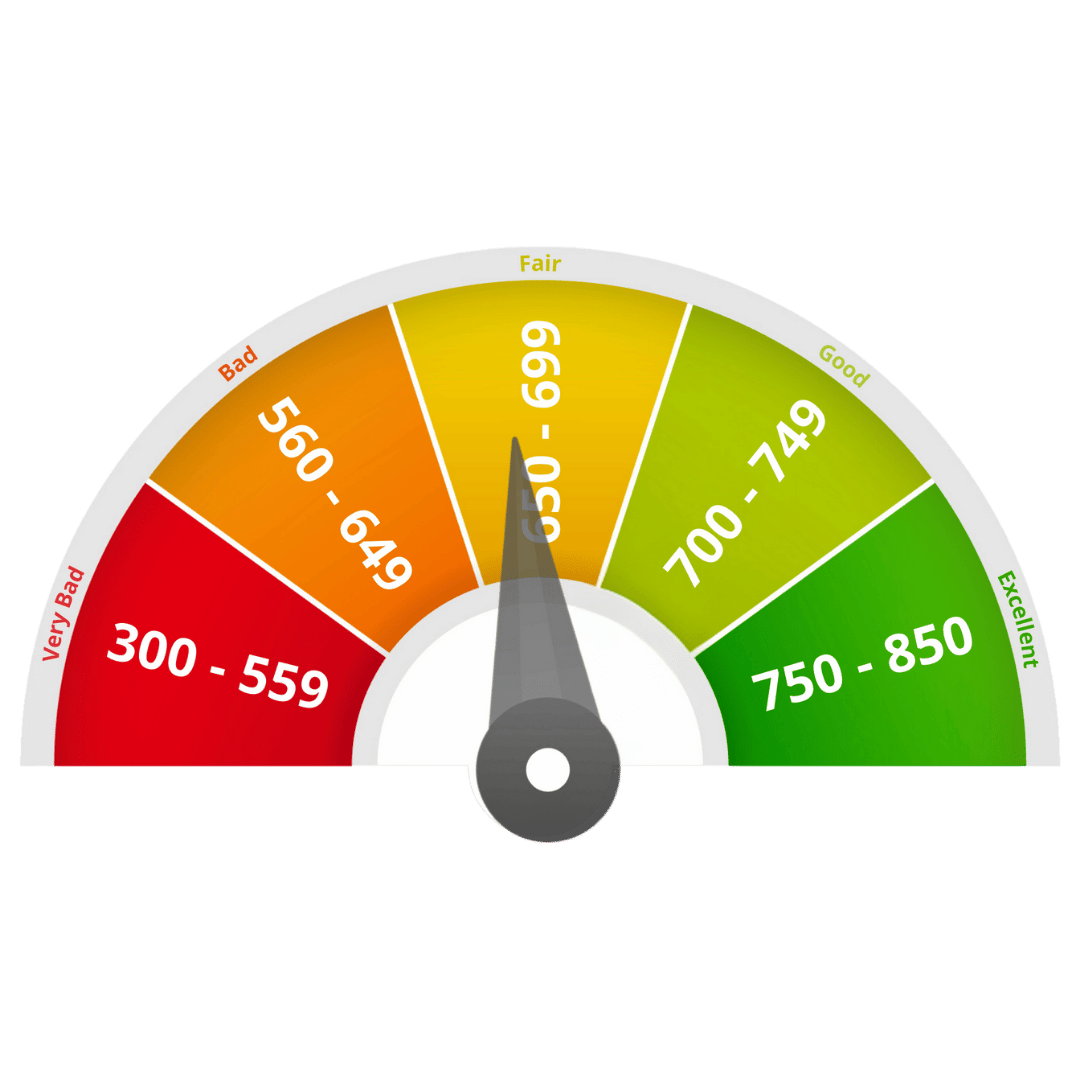

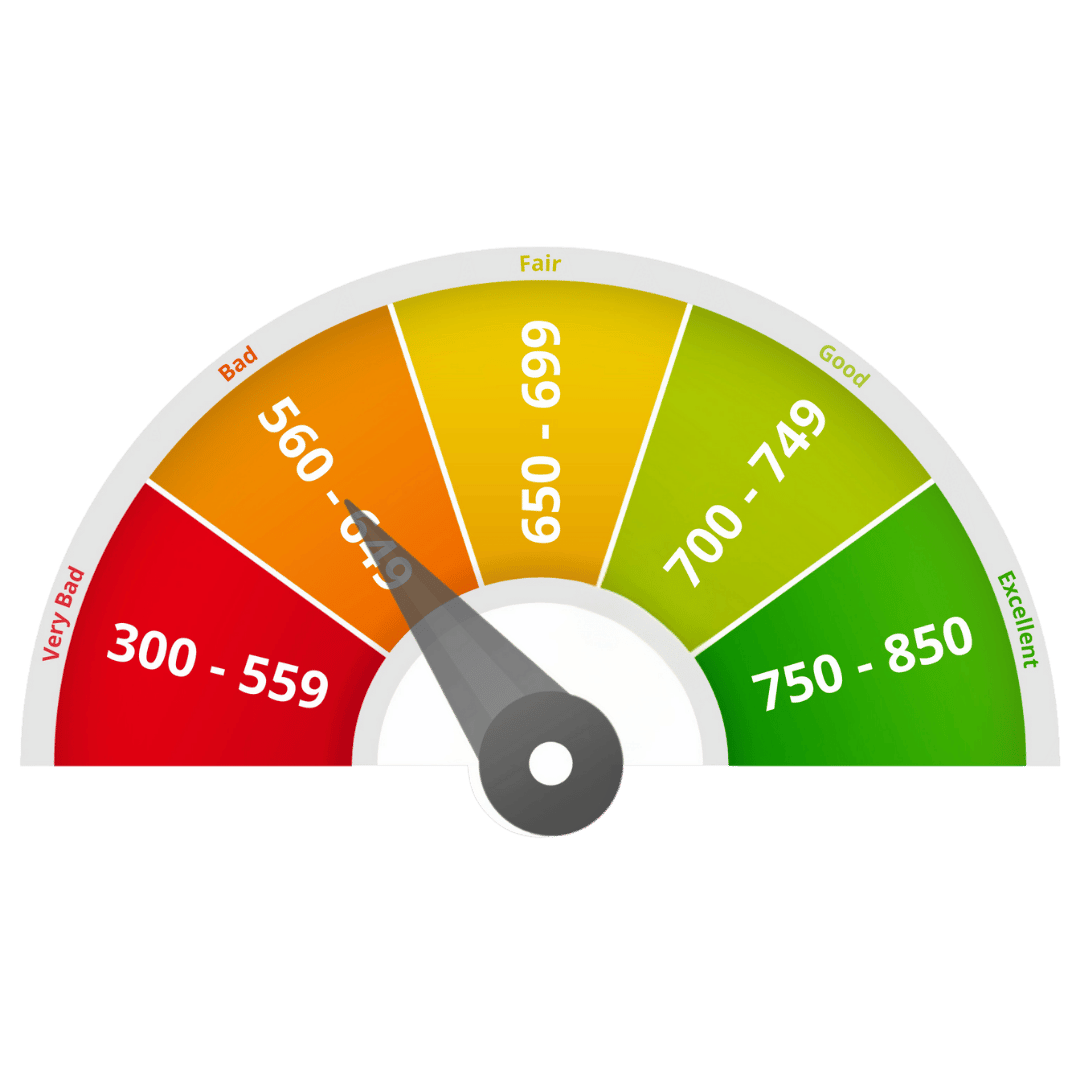

Understanding Your Credit Score and Mortgage Eligibility

You credit score can either be the key to unlocking favorable mortgage rates, terms, and opportunities, or the hurdle that keeps your dream of homeownership just out of reach.

In this chapter, we'll decode the different credit score ranges, revealing what each means for securing financing for your new home.

- Where You Stand: Understand your current credit score's implications.

- Available Opportunities: Learn which mortgage options are within your grasp.

- Path to Improvement: Get insights on how to enhance your score, unlocking better financial possibilities for your future home.

Excellent: 750-850

- Ultra-low interest rates

- Lightning-fast mortgage approvals

- Access to exclusive financing options

Good: 700-749

Solid Foundation: You're in a great spot! Lenders view you favorably, offering:- Competitive interest rates

- Attractive financing terms

Fair: 650-699

Room for Improvement: You can still get approved for a mortgage, but:- Expect additional paperwork from lenders

- Be prepared for slightly higher interest rates

Poor: 560-649

Time to Refocus: You're facing challenges, but don't worry, it's not a dead end. Be prepared for:- Cautious lenders

- Higher interest rates

- Collateral-based mortgages

- Specialized lending programs

Use this as a motivation to prioritize credit repair and get back on track!

Critical: Below 560

Take a Breath, Reassess: Financing might be tough, and lenders may require:- A cosigner

- Substantial collateral

- Learn from our credit repair strategies

- Rebuild trust with lenders

- Work towards financial freedom and your dream home. You've got this!

Chapter 4

5 Steps to Repair Your Credit for a Mortgage Loan

Step 1: Check Your Credit Report for Errors

- Incorrect late payments

- Accounts that aren’t yours

- Outdated negative marks

Dispute any errors with the credit bureaus to ensure your score reflects accurate information.

Step 2: Pay Down Outstanding Debt

Your credit utilization ratio—how much of your available credit you’re using—plays a huge role in your score. Lowering your credit card balances can provide a quick boost.

Step 3: Make On-Time Payments a Priority

Payment history makes up 35% of your credit score. Set up automatic payments or reminders to ensure you never miss a due date.

Step 4: Avoid New Credit Applications

Every time you apply for credit, a hard inquiry is recorded, which can lower your score. Minimize new credit applications while preparing for a mortgage.

Step 5: Build Positive Credit Habits

Consider using credit-building tools like secured credit cards or becoming an authorized user on a responsible person’s account to demonstrate financial responsibility.

Congratulations on Making it to the End!

Repairing your credit doesn’t happen overnight, but every positive step brings you closer to getting approved for a mortgage and securing your future home.

✅ Check your credit report and correct errors

✅ Reduce outstanding debt and lower your utilization

✅ Make on-time payments your top priority

✅ Hold off on new credit applications

✅ Stay consistent and patient

By following this guide, you’ll not only improve your credit but also unlock better mortgage rates, save thousands over time, and move into your dream home with confidence.